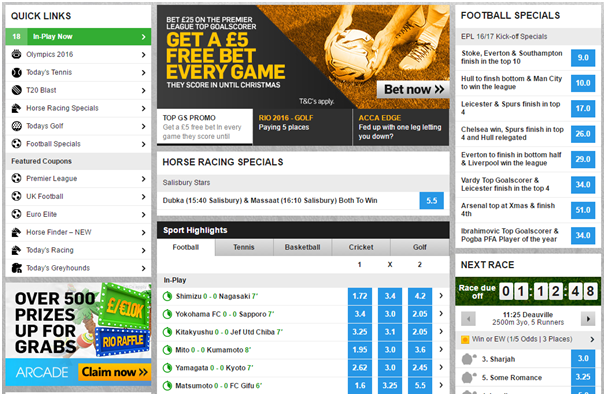

Financial Betting Betfair

Scheduled release date: 3 June 2020

- This long-standing peace of Betfair trading software was created by Peter Webb. There are three different options available now. These are called Bet Angel Trader, Bet Angel Professional and Bet Angel Basic. The Professional version brings together a wide range of features. This includes a powerful chart building feature.

- Your early look at the Federal Election odds, with an expert preview. The Political Pundits preview the next Federal Election and disucss the Labor momentum. Can the Coalition turn around the polls or are they destined for defeat. Find out the Federal Election odds and get the political bets.

- PPB Counterparty Services Limited, having its registered address at Triq il-Kappillan Mifsud, St. Venera, SVR 1851, MALTA, is licensed and regulated by the Malta Gaming Authority under Licence Number MGA/CRP/131/2006 (issued on 01 August 2018). For customers in the UK, PPB Counterparty Services Limited, Betfair Casino Ltd and PPB Entertainment Limited are licensed by the Gambling Commission.

- House Price Harry, the Hub’s financial betting expert, will be sharing his quarterly GDP and CPI tips. New to the Exchange in 2020, markets for Australian GDP and CPI quarterly results are being offered. House Price Harry has drawn on his wealth of experience in the economic sector to share his thoughts and best bets for both markets.

'55', 'name' = 'Financials', 'category' = ', 'path' = '/var/www/vhosts/betting.betfair.com/httpdocs/financials/', 'url' = 'https://betting.betfair.com/financials.

The recent information flow for the sub-sets of data that feed into the GDP result suggests the impact of the COVID-19 crisis on the real GDP growth in the March quarter is relatively modest, with a range of offsetting factors at play.

In the March quarter, household consumption spending held up with booming spending in supermarket hoarding of toilet paper, pasta and rice, although this was partly offset by falls in spending in restaurants, cafes and pubs. In real terms, retail sales rose a moderate 0.7% which will add around 0.2 percentage points to GDP growth in the quarter. Exports were very strong through to March, with resources and agriculture remaining resilient while tourism and foreign student arrivals fell sharply.

Business investment was likely weak in the quarter but this could be countered by solid spending by the government, including on infrastructure. The net effect of these two variables is likely to be broadly neutral.

Betfair Website

Based on available information, GDP growth is likely to be in a range of around 0.0% with risks evenly balanced. Up or down. The next few weeks will see the publication of further data which will feed into expectations for GDP when the data are released on 3 June 2020.